Solid Protection with Top-Rated Insurance for Jewelers in Michigan

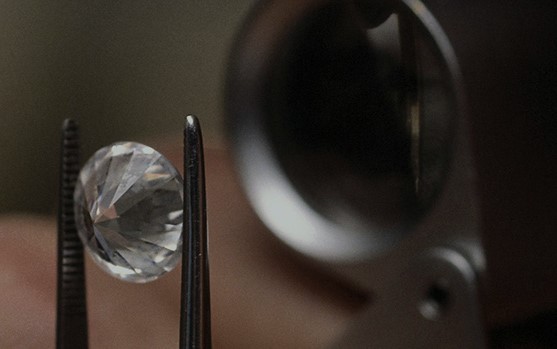

Just like jewelry, precious metals and gems themselves, insurance for jewelers is highly individual and specialized.

Just like jewelry, precious metals and gems themselves, insurance for jewelers is highly individual and specialized.

There are only a handful of insurance companies that provide protection for these high-value-inventory businesses and the company leading the way is Jewelers Mutual Insurance Group. Since 1913, Jewelers Mutual has been the only company in the U.S. and Canada dedicated to personal jewelry insurance and jewelry business insurance.

In Michigan, there are only three agencies representing Jewelers Mutual. You’re right here with one of those agencies now and you need look no further for price competitive, quality coverage for your Michigan-based jewelry business including:

- Jewelers Block Insurance. This is the standard protection plan for the industry, covering losses from burglary, robbery, sneak theft, fire, other natural disasters and more. It covers inventory, raw materials and customers’ property entrusted to you.

- Business Owners Policy (BOP) tailored specifically for the needs of jewelry businesses in Michigan. This covers many day-to-day business risks including commercial liability, crime, and property insurance.

- Commercial Liability, which provides lawsuit protection in case someone is injured at your business.

- Jewelry Appraisal Liability insurance to protect your professional reputation – for example against claims arising from disputed appraisal values.

- Product liability insurance for claims of injury or damage arising from a product you sell.

- Commercial auto insurance including coverage for non-owned vehicles used for business activities.

- Employee-related insurance including workers’ compensation, employee dishonesty, and employment practices liability insurance.

- Cyber insurance to help cover costs associated with data breaches and protection of privacy – an increasingly high risk these days.

- Commercial Umbrella Insurance to raise the liability limits of insurance coverage on other policies. Especially valuable and important to jewelers.

Our Jeweler Insurance Program

Mt. Pleasant Agency – Central Insurance has been protecting businesses in this region for well over half a century. And we’ve established an unbeatable reputation for personal service in specialist jewelers insurance, as well as personal jewelry owners protection. Through Jewelers Mutual Insurance Group and other leading business insurers, we’ve developed a wide-ranging program of coverage and serve jewelry stores all over the state of Michigan with the majority of those based in Central and Northern Michigan.

We can arrange protection for many types of jewelry businesses including jewelry retailers and wholesalers, trade event organizers, pawn brokers, jewelry manufacturers and repairers, specialist dealers in precious metals and stones, and Internet retailers.

Why Mt. Pleasant Agency – Central Insurance is your Solution

As you can see, there are many dimensions to jewelry business insurance. We will help you understand and identify the coverage you need so that you’re not exposed to uncovered risks – but also so that you don’t pay for coverage you don’t need.

Mt. Pleasant Agency – Central Insurance is already trusted by hundreds of businesses in central Michigan and beyond to do just that.

We’re a people business. We don’t think of our activities as being so much about insuring companies as we do about protecting owners, employees, their property and the livelihoods of our customers.

We make the time to know and understand the individual needs of our customers and we stand ready to answer questions, troubleshoot insurance problems, and offer advice to you.

We can provide guidance on risk management and other security issues associated with the jewelry industry.

And if you need to make a claim, our team will be standing by to help and support you.

Free, No-Commitment Quote

Whether you’re reviewing your existing jewelers insurance policy or you’re just getting started with your business, you don’t need to look any further than Mt. Pleasant Agency – Central Insurance, for the protection you need.

You can find out more without cost or without any kind of obligation by simply calling or contacting us via this website and requesting a quote.

We can also answer your questions, tell you about our hundreds of satisfied customers, and give you the information you need to make an informed decision for your business.